Headwinds of Change: SC, SCOA and JGC

Collaborate on Floating Offshore Wind Project

According to the International Renewable Energy Agency (IRENA), floating offshore wind (FOW) is one of the fastest-growing sectors in renewable energy, citing that FOW installations are expected to increase from just over 100 MW installed in 2021 to over 10 GW by 2030. With new projects planned across Europe, Asia, and North America, this rapid expansion reflects advancements in technology, more favorable regulatory frameworks, and increased investment in clean energy initiatives.

Considering this forecast, SC, SCOA and JGC Japan Corporation have joined forces to help advance the FOW sector. Their collaborative effort aims to produce up to 100 floating turbine foundations annually by 2030, a step toward meeting the global push for carbon neutrality by 2050. A true global effort, SCOA’s Chicago office is playing a key role in the partnership, highlighting Sumitomo’s strategic focus on scaling sustainable energy infrastructure in regions like the U.S., where future demand is outpacing available capacity, and the supply chain needs to be developed.

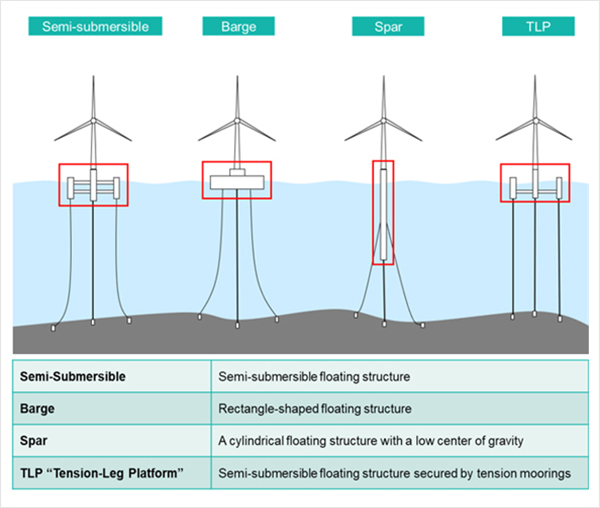

With the FOW sector growing fast, and larger turbines and deeper water locations offering unparalleled energy capture, the logistics behind this revolution are as daunting as the promise of clean energy itself. Each floater—a massive structure weighing up to 4,000 metric tons—requires a network of fabricators and transportation that span oceans and continents. The SC and JGC partnership is designed to confront these logistical and infrastructure hurdles head-on, with a sharp vision for the future. At the same time, SCOA’s Chicago-based Specialty Steel, Plate & Fabrication Department of the Metal Products Group headed by Group GM Michitaka Tanoue and under Automotive Division GM Koji Fukushima will spearhead the assessment of the U.S. market’s current capacity to support offshore wind while also working closely with JGC to fill in those gaps.

“We have been involved in this partnership internationally, but in Chicago our primary focus will be to support American projects and to evaluate the current supply chain and identify gaps & bottlenecks that exist,” said Emily Lee, Senior Director and General Manager of SCOA’s Specialty Steel, Plate & Fabrication Dept.

The logistical challenges on the U.S. West Coast are particularly complex, where existing infrastructure struggles to keep pace with the scale of work needed for FOW projects.

“The expected need to assemble these at sites close to potential project areas is a very big challenge, as there is not much infrastructure currently in place on the US West Coast that can handle the scale of work that needs to be done,” Lee explained.

SC and JGC are committed to building the capabilities needed, not only through their American partnerships but also with global fabricators. Sumitomo is tapping into its vast network in steel supply chains, while JGC brings its modular fabrication experience honed from decades in the energy sector. SCOA’s Chicago office, in conjunction with JGC, can bridge these gaps by leveraging partnerships and investments in shipbuilding infrastructure. One such investment is the expansion at Oshima Shipyard’s Koyagi yard in Nagasaki, which includes a large dry dock that could play a crucial role in reaching the ambitious goal of 100 floaters per year by 2030.

“Sumitomo will manage steel supply chains as well as transportation, and JGC will oversee assembly and potentially installation,” said Lee, outlining the dual responsibilities that will drive the partnership’s success.

While concrete designs for floaters may have a place, SC is currently focusing its efforts on steel—critical to their supply chain strategy. Joshua H. Longman, Business Development Manager for SCOA’s Steel & Non-Ferrous Metal Division indicated that with an extensive network of fabricators and maritime logistics expertise, Sumitomo plans to create an integrated solution for the industry.

“Our partnership will connect JGC’s knowledge of modular fabrication with Sumitomo’s Ship & Marine SBU’s focus on logistics. This department is not only active in building ships, but also owning and operating them,” explained Longman.

“JGC has already done this kind of work in the oil & gas sector, where the design complexity was much more complicated compared to that of a wind floater,” Lee noted.

This experience will be crucial in overcoming one of the biggest challenges of offshore wind: standardizing production at scale. In the coming years, SC and JGC aim to standardize and streamline the production process for wind floaters on an unprecedented scale. The early focus will be on building a global network of fabricators and solving logistical bottlenecks, with the Chicago office continuing to play a key role in advancing U.S.-based projects.

“Currently, we are perfecting the process flow and tackling logistics challenges, so our capacity will be lower in the next few years. We have our targets, but it will be lower in the near term as we ramp up and continue to integrate production partners,” Longman explained.

As the world pivots to renewable energy, SC and JGC’s partnership looks to make floating offshore wind a major part of the global energy mix. By leveraging their combined expertise in steel supply, marine logistics, and modular engineering, they are laying the groundwork for an industry capable of driving the energy transition forward. SCOA is helping steer the ship, ensuring that the FOW sector meets its ambitious targets and transforms how the world generates clean energy.